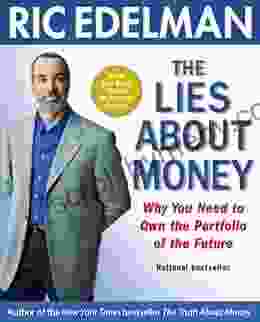

Achieving Financial Security and True Wealth: Avoiding the Lies Others Tell

In a world where financial misinformation runs rampant, it's becoming increasingly difficult to navigate the murky waters of personal finance. From dubious investment schemes to misleading financial advice, it's easy to fall into the traps that can derail your financial goals.

That's why it's crucial to arm yourself with the knowledge and understanding necessary to discern financial truth from fiction. In this comprehensive guide, we will expose the most common financial lies that can hinder your progress towards financial security and true wealth.

4.4 out of 5

| Language | : | English |

| File size | : | 8007 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Lie 1: You Need to Be Rich to Invest

This is one of the biggest misconceptions that prevents many people from starting their investment journey. The truth is, you don't need a large sum of money or a high income to invest. With modern investment platforms, you can start investing with as little as a few dollars.

Lie 2: Higher Returns Equal Higher Risk

While it's generally true that higher-return investments carry more risk, it's not always the case. There are many low-risk investments that can provide decent returns, especially over the long term. Diversification is key to reducing risk and achieving a balance between reward and safety.

Lie 3: Saving is the Key to Financial Freedom

Saving is important, but it's not the only factor that contributes to financial freedom. Investing your savings wisely and growing your wealth is equally essential. Passive income streams, such as rental properties or dividend-paying stocks, can significantly boost your financial security.

Lie 4: You Can't Afford Retirement

This is another common lie that can prevent people from planning for their future. While retirement may seem like a distant dream, it's never too early to start saving and investing. Even small contributions made regularly can grow into a substantial retirement nest egg over time.

Lie 5: Debt is Normal and Unavoidable

In today's consumer-driven society, it's easy to accumulate debt, but it's important to remember that debt is not inevitable. By living below your means, avoiding unnecessary expenses, and managing your credit wisely, you can minimize debt and improve your financial health.

Lie 6: You Can Time the Market

Market timing is a fool's errand. While some investors may get lucky occasionally, it's impossible to consistently predict market movements with accuracy. The best investment strategy is to stay invested for the long term and ride out market fluctuations.

Lie 7: You Need a Financial Advisor to Manage Your Money

While financial advisors can provide valuable guidance, you don't need one to manage your money effectively. With the abundance of information available online and through financial literacy programs, you can educate yourself and make informed financial decisions.

Lie 8: Following Your Passion Will Make You Rich

While it's important to enjoy your work, it's not a guarantee of financial success. In most cases, financial wealth is built through hard work, dedication, and smart financial planning. Don't mistake passion for a career path that may not be financially viable.

Lie 9: Real Estate Is Always a Good Investment

Real estate can be a great investment, but it's not without its risks. The real estate market can fluctuate, and there are many factors that can affect the value of a property. Don't invest in real estate solely based on the assumption that it will always appreciate in value.

Lie 10: Cryptocurrencies Are a Safe Way to Make Money

4.4 out of 5

| Language | : | English |

| File size | : | 8007 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Coral Vass

Coral Vass Oscar Ratti

Oscar Ratti Sergei Urban

Sergei Urban Kirsten Koza

Kirsten Koza Susan B Katz

Susan B Katz Thomas J Craughwell

Thomas J Craughwell Colette Rossant

Colette Rossant Crysta Mchenry

Crysta Mchenry J M Gregson

J M Gregson Judi Kesselman Turkel

Judi Kesselman Turkel Mark Whitaker

Mark Whitaker John L Bennett

John L Bennett Jennifer Easley

Jennifer Easley Dale Grdnic

Dale Grdnic Clodagh Dunlop

Clodagh Dunlop Cornelius Tacitus

Cornelius Tacitus Peter Richardson

Peter Richardson Devon Price

Devon Price Michael Lakin

Michael Lakin Julie Boye

Julie Boye

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Melvin BlairUnleash the Thrills: Dive into "The Double Dangerous For Boys," the Ultimate...

Melvin BlairUnleash the Thrills: Dive into "The Double Dangerous For Boys," the Ultimate...

Chandler WardUnleash Your Inner Keyboard Warrior: A Review of Craig Payne's Gripping Tech...

Chandler WardUnleash Your Inner Keyboard Warrior: A Review of Craig Payne's Gripping Tech...

Ezekiel CoxUnleash Your Teaching Potential: Master the TEXES Exam with Our Comprehensive...

Ezekiel CoxUnleash Your Teaching Potential: Master the TEXES Exam with Our Comprehensive... Lawrence BellFollow ·6k

Lawrence BellFollow ·6k Brian WestFollow ·6k

Brian WestFollow ·6k Matt ReedFollow ·15k

Matt ReedFollow ·15k José SaramagoFollow ·18.4k

José SaramagoFollow ·18.4k Chase MorrisFollow ·12.8k

Chase MorrisFollow ·12.8k Stanley BellFollow ·13.9k

Stanley BellFollow ·13.9k Emmett MitchellFollow ·12.2k

Emmett MitchellFollow ·12.2k Ryūnosuke AkutagawaFollow ·5.5k

Ryūnosuke AkutagawaFollow ·5.5k

Cruz Simmons

Cruz SimmonsUnveiling the Secrets: An Insider Guide to School Bonds...

Unlock the Power of School...

Gil Turner

Gil TurnerRuins of Empire: Blood on the Stars - The Epic Space...

Ruins of Empire: Blood on the Stars is the...

Allen Ginsberg

Allen GinsbergPrepare for the Ultimate Space Opera: Delve into The Last...

Embark on an...

Anton Foster

Anton FosterUnleash Your Inner Artist: The Ultimate Guide to Oil...

Chapter 1: The...

4.4 out of 5

| Language | : | English |

| File size | : | 8007 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |