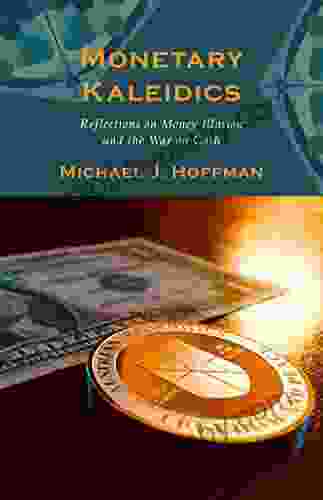

Reflections On Money Illusion And The War On Cash: A Comprehensive Guide

In the realm of economics, the concept of money illusion has long captivated the minds of scholars and policymakers alike. Money illusion refers to the tendency for individuals to perceive and value money in nominal terms, without fully accounting for changes in its purchasing power. This seemingly irrational behavior has profound implications for economic decision-making and the overall health of the financial system.

4.7 out of 5

| Language | : | English |

| File size | : | 1605 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 330 pages |

| Lending | : | Enabled |

Concurrently, the ongoing war on cash has emerged as a contentious issue, pitting advocates of digital payments against proponents of physical currency. The war on cash encompasses a range of policies and initiatives aimed at reducing or eliminating the use of cash in society. This article aims to provide a comprehensive exploration of these interconnected phenomena, examining their historical roots, theoretical underpinnings, and real-world consequences.

The Concept of Money Illusion

The idea of money illusion was first formally introduced by Irving Fisher in his seminal work "The Purchasing Power of Money" (1911). Fisher argued that individuals tend to think about money in terms of its nominal value, rather than its real value, which is its purchasing power in relation to goods and services. This cognitive bias can lead to a number of economic distortions, including:

- Inflationary expectations: Money illusion can contribute to inflationary expectations, as individuals may underestimate the true rate of inflation due to their focus on nominal prices.

- Wage rigidity: Money illusion can also lead to wage rigidity, as workers may be reluctant to accept nominal wage cuts even when the real value of their wages is rising.

- Deflationary spirals: In extreme cases, money illusion can contribute to deflationary spirals, as individuals may hoard cash, leading to a decrease in aggregate demand and a further decline in prices.

Historical Roots of Money Illusion

The roots of money illusion can be traced back to the historical evolution of money. In early societies, money often took the form of precious metals, such as gold or silver. These metals had intrinsic value and were widely accepted as a medium of exchange. However, as societies grew more complex, paper currency and other forms of fiat money became more prevalent. These currencies were not backed by any physical commodity and their value was based solely on the trust and confidence of the public.

The of fiat currency created the potential for money illusion. Unlike commodity money, fiat currency does not have an inherent value that is independent of its nominal worth. As a result, individuals may be more likely to perceive fiat currency in nominal terms, even when its purchasing power is declining.

The War on Cash: Origins and Motivations

The war on cash is a relatively recent phenomenon, gaining momentum in the early 21st century. Proponents of digital payments argue that cash is inefficient, costly, and prone to counterfeiting and other forms of illicit activity. They also suggest that digital payments can increase transparency and reduce the risk of tax evasion.

Governments and central banks have been at the forefront of the war on cash, implementing policies such as:

- Demonetization: The withdrawal of high-denomination banknotes from circulation, as seen in India's 2016 demonetization initiative.

- Negative interest rates: Charging interest on cash deposits, as implemented by several central banks in recent years.

- Digital payment incentives: Providing subsidies or rewards for the use of digital payment methods.

Consequences of the War on Cash

The war on cash has far-reaching implications for individuals and society as a whole. The following are some of the potential consequences:

- Financial exclusion: Eliminating or reducing cash could disproportionately affect certain segments of the population, such as the elderly, low-income individuals, and those living in remote areas with limited access to digital infrastructure.

- Centralization of power: The war on cash could lead to increased centralization of financial power in the hands of governments and large technology companies.

- Privacy concerns: Digital payment systems can collect and store vast amounts of data on spending habits and other personal information, raising concerns about privacy and surveillance.

Balancing Innovation and Tradition

The ongoing war on cash highlights the need to strike a balance between innovation and tradition. Digital payments offer numerous advantages, including convenience, speed, and transparency. However, it is essential to preserve the accessibility and privacy benefits of cash. A thoughtful and measured approach is required to ensure that the transition to a digital-centric financial system is inclusive, equitable, and respectful of individual preferences.

Money illusion and the war on cash are complex phenomena with significant implications for economic decision-making and the overall functioning of society. By understanding the historical roots, theoretical underpinnings, and real-world consequences of these issues, we can engage in informed discussions and develop sound policies that promote financial stability and inclusivity.

The journey towards a more equitable and efficient financial system requires careful consideration of the role of both cash and digital payments. By embracing innovation while preserving the benefits of traditional currency, we can create a monetary landscape that serves the needs of the 21st century and beyond.

4.7 out of 5

| Language | : | English |

| File size | : | 1605 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 330 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Dixie Dansercoer

Dixie Dansercoer Sean Masaki Flynn

Sean Masaki Flynn Cushy Monkey

Cushy Monkey Haylie Duff

Haylie Duff Rachel Campos Duffy

Rachel Campos Duffy D Rus

D Rus Nicole Unice

Nicole Unice Curt Gentry

Curt Gentry Cynthea Masson

Cynthea Masson D J Thomas

D J Thomas Cristela Alonzo

Cristela Alonzo Cody Monk

Cody Monk Sandra T Barnes

Sandra T Barnes Robin Farley

Robin Farley Cp Lowe

Cp Lowe Randy Russell

Randy Russell Claudia J Carr

Claudia J Carr Cynthia Clumeck Muchnick

Cynthia Clumeck Muchnick Cynthia Clampitt

Cynthia Clampitt Wilbur Cross

Wilbur Cross

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

John UpdikeFollow ·17.5k

John UpdikeFollow ·17.5k Colt SimmonsFollow ·12.3k

Colt SimmonsFollow ·12.3k Federico García LorcaFollow ·5.4k

Federico García LorcaFollow ·5.4k Joseph FosterFollow ·13.2k

Joseph FosterFollow ·13.2k Ethan MitchellFollow ·7.2k

Ethan MitchellFollow ·7.2k Yasushi InoueFollow ·4.1k

Yasushi InoueFollow ·4.1k Darrell PowellFollow ·12.4k

Darrell PowellFollow ·12.4k Chandler WardFollow ·4.4k

Chandler WardFollow ·4.4k

Cruz Simmons

Cruz SimmonsUnveiling the Secrets: An Insider Guide to School Bonds...

Unlock the Power of School...

Gil Turner

Gil TurnerRuins of Empire: Blood on the Stars - The Epic Space...

Ruins of Empire: Blood on the Stars is the...

Allen Ginsberg

Allen GinsbergPrepare for the Ultimate Space Opera: Delve into The Last...

Embark on an...

Anton Foster

Anton FosterUnleash Your Inner Artist: The Ultimate Guide to Oil...

Chapter 1: The...

4.7 out of 5

| Language | : | English |

| File size | : | 1605 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 330 pages |

| Lending | : | Enabled |