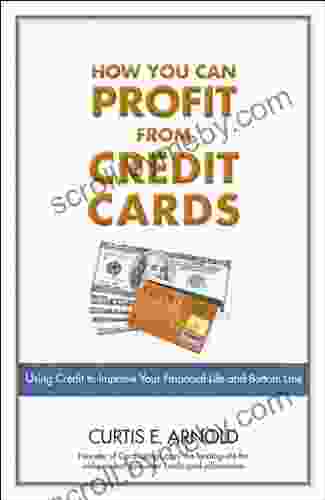

Using Credit To Improve Your Financial Life And Bottom Line

Unveiling the Secrets of Smart Credit Management

In the realm of personal finance, credit plays a pivotal role, shaping our financial well-being and influencing our ability to achieve our financial goals. However, navigating the complexities of credit can be a daunting task, often shrouded in misconceptions and misunderstandings.

4.3 out of 5

| Language | : | English |

| File size | : | 1392 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 354 pages |

This comprehensive guidebook, "Using Credit to Improve Your Financial Life and Bottom Line," serves as your trusted companion on this empowering journey. Within these pages, you will discover the transformative power of credit when harnessed wisely. It empowers you to build a strong credit history, manage debt effectively, and maximize credit's potential to enhance your financial life and bottom line.

Chapter 1: Demystifying Credit and Its Impact

Embarking on this chapter, you will gain a foundational understanding of credit: its nature, types, and the significance of a good credit score. Delve into the mechanics of credit reporting, unraveling the factors that influence your creditworthiness and how to monitor your credit report diligently.

Chapter 2: Establishing and Building a Stellar Credit History

Laying the groundwork for financial success begins with establishing and nurturing a robust credit history. This chapter provides a step-by-step roadmap to building credit from scratch, offering practical strategies to improve your credit score and maintain its health over time.

Chapter 3: The Art of Debt Management: A Path to Financial Freedom

Navigating debt is an integral aspect of credit management. This chapter empowers you with effective debt management techniques, from understanding different types of debt to developing a personalized debt repayment plan. Learn how to prioritize debts, negotiate with creditors, and avoid the pitfalls of excessive debt.

Chapter 4: Credit Optimization: Leveraging Credit to Your Advantage

Moving beyond debt management, this chapter delves into the strategic use of credit to enhance your financial well-being. Discover how to harness credit cards, loans, and other credit products to build wealth, fund major Free Downloads, and improve your overall financial situation.

Chapter 5: Credit Repair: Restoring Your Financial Health

Life's unexpected challenges can sometimes lead to credit setbacks. This chapter provides a comprehensive guide to credit repair, equipping you with the knowledge and strategies to overcome credit issues, rebuild your credit history, and restore your financial health.

Chapter 6: Credit, Identity Theft, and Fraud: Protecting Your Financial Lifeline

In today's digital age, it's crucial to safeguard your credit against fraud and identity theft. This chapter raises awareness about these threats, empowering you with practical measures to protect your credit information and mitigate the risks associated with identity theft.

Chapter 7: Credit and Financial Planning: A Synergistic Approach

Integrating credit management into your overall financial plan is essential for long-term financial success. This chapter explores the symbiotic relationship between credit and financial planning, demonstrating how to align your credit strategies with your financial goals, such as saving for retirement, purchasing a home, or funding your child's education.

: Empowering You with Credit Mastery

As you complete your journey through this guidebook, you will emerge as a confident and empowered individual, equipped with the knowledge and skills to use credit wisely, improve your financial life, and lay the foundation for a secure and prosperous financial future.

Remember, credit is a powerful tool that can work for you or against you. By embracing the principles outlined in this book, you can harness the transformative power of credit to achieve your financial dreams and unlock a world of financial freedom.

Take the first step towards financial empowerment today. Free Download your copy of "Using Credit to Improve Your Financial Life and Bottom Line" and embark on the path to financial well-being.

4.3 out of 5

| Language | : | English |

| File size | : | 1392 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 354 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Clive Cussler

Clive Cussler Craig Carey

Craig Carey Clinton Spurr

Clinton Spurr John D Mcdougall

John D Mcdougall Colette Harris

Colette Harris Sean Iddings

Sean Iddings Judi Kesselman Turkel

Judi Kesselman Turkel Douglas K Smith

Douglas K Smith Frank Gus Biggio

Frank Gus Biggio Jason Curtis

Jason Curtis Courtenay Fletcher

Courtenay Fletcher Gregory N Brown

Gregory N Brown Elizabeth Mcdavid Jones

Elizabeth Mcdavid Jones Creative Orthodox

Creative Orthodox Claudio Irigoyen

Claudio Irigoyen Yellowlees Douglas

Yellowlees Douglas Martina Nohl

Martina Nohl Francesco Lo Iacono

Francesco Lo Iacono Katie Hickey

Katie Hickey Cynthea Liu

Cynthea Liu

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Mikhail BulgakovFollow ·19.3k

Mikhail BulgakovFollow ·19.3k Elias MitchellFollow ·13.7k

Elias MitchellFollow ·13.7k Grayson BellFollow ·7k

Grayson BellFollow ·7k Evan HayesFollow ·10.3k

Evan HayesFollow ·10.3k Clayton HayesFollow ·12.7k

Clayton HayesFollow ·12.7k Dallas TurnerFollow ·12.6k

Dallas TurnerFollow ·12.6k Vince HayesFollow ·18.7k

Vince HayesFollow ·18.7k Kelly BlairFollow ·6.8k

Kelly BlairFollow ·6.8k

Cruz Simmons

Cruz SimmonsUnveiling the Secrets: An Insider Guide to School Bonds...

Unlock the Power of School...

Gil Turner

Gil TurnerRuins of Empire: Blood on the Stars - The Epic Space...

Ruins of Empire: Blood on the Stars is the...

Allen Ginsberg

Allen GinsbergPrepare for the Ultimate Space Opera: Delve into The Last...

Embark on an...

Anton Foster

Anton FosterUnleash Your Inner Artist: The Ultimate Guide to Oil...

Chapter 1: The...

4.3 out of 5

| Language | : | English |

| File size | : | 1392 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 354 pages |